Market

Lucas Energy, Inc. (NYSEMKT:LEI) buys up Oklahoma assets; Re: Marathon Oil Corporation (NYSE:MRO)

Published

10 years agoon

Lucas Energy, Inc. (NYSEMKT:LEI) announced today that is has signed a purchase agreement to acquire, from 21 different entities and individuals, working interests in producing properties and undeveloped acreage. The assets being acquired include varied interests in two largely contiguous acreage blocks in the liquids-rich Mid-Continent region. The properties currently produce in excess of 1,200 net barrels of oil equivalent per day (BOE/d), of which 53% are liquids from 114 producing wells. The bulk of the production is from the Hunton formation holding approximately 43,000 gross acres (9,900 net acres) in central Oklahoma. Further, offset development drilling opportunities for at least 40 additional wells have already been identified. According to a recent third-party reserve report (as of December 1, 2015), total proved developed reserves (PDP) are 5.4 million barrels of oil equivalent (MMBOE) comprised of 6% oil, 47% natural gas liquids (NGL) and 47% natural gas.

LEI JUMPED OVER 300% TODAY! GET UP TO THE MINUTE STOCK ALERTS BEFORE THEY BREAKOUT! FREE STOCK CHATROOM

SAFE-GUARDING THE CAPITAL STRUCTURE

Prior to entering into the acquisition agreement, and as previously disclosed, Lucas has completed the transfer of its existing oil and gas assets and current and outstanding senior debt obligations through a conveyance to a wholly-owned special purpose vehicle (SPV), non-recourse to Lucas Energy, Inc. Lucas’s senior lender will maintain its rights to the assets of the SPV. This restructuring allowed Lucas the ability to enter into the acquisition agreement described above in order to pursue its strategic objective of adding significant production and increasing the scope and scale of the Company.

GO FORWARD STRATEGY

“The completion of this transaction will raise the trajectory of opportunities for Lucas, not only as we increase our existing production base and future development opportunities, but also as we expand our reach into a key play in the Mid-continent and broaden our strategic horizons,” said Anthony C. Schnur, Lucas’s Chief Executive Officer. “We are extremely excited to have identified an acquisition that provides us with stable, long-lived reserves with substantial current production and ample drilling opportunities that are economic in a prolonged depressed commodity price environment. We are further encouraged by the planned upcoming additions to our board, especially the appointment of Richard N. Azar II as our Chairman. I have known Richard over the last three years, and I welcome his depth of knowledge and strategic sense to our Company.”

TRANSACTION OVERVIEW

The asset purchase agreement contains customary representations and warranties of the parties and rights of termination. The closing of the acquisition is subject to closing conditions including Lucas placing the commercial bank facility to fund the $4.975 million cash required to acquire the properties; Lucas obtaining stockholder approval for the issuance of the shares of common stock in the closing and upon conversion of the preferred stock; the effectiveness of a registration statement registering the common stock and common stock issuable upon conversion of the preferred stock issued at closing; Lucas’s continued listing on the NYSE MKT prior to and following the closing;; and the consent of various creditors of the sellers. The parties are targeting a closing date, subject to the satisfaction or waiver of the required closing conditions, of Lucas’s first fiscal quarter of 2016.

Post-closing there will be 14,514,902 shares of common stock issued and outstanding; assuming there are no adjustments through the diligence and closing process. Additionally, the new class of preferred stock to be issued at closing will be convertible into 3,941,280 shares of common stock and will bear a 6.0% annual dividend rate payable in cash, common stock or PIK at Lucas’s option. The preferred, which has a face value and liquidation preference of $25 per share, a conversion rate into common stock of 7.14:1, will be convertible at any time at a price of $3.50 per share. Under certain conditions, it will convert automatically.

More information regarding the purchase agreement, planned acquisition and the terms and conditions thereof have been disclosed in the Current Report on Form 8-K filed by Lucas today with the Securities and Exchange Commission.

ROTH Capital Partners acted as financial advisor on the Transaction.

INVESTOR UPDATE CONFERENCE CALL

Management intends to schedule a conference call in the first calendar quarter of 2016 to discuss these developments with investors and further information regarding the call will be disclosed when available.

GET UP TO THE MINUTE STOCK ALERTS BEFORE THEY BREAKOUT! FREE STOCK CHATROOM

About Lucas Energy, Inc.

Lucas Energy (NYSE MKT: LEI) is engaged in the production of crude oil and natural gas in the Austin Chalk and Eagle Ford formations in South Texas. Based in Houston, Lucas’s management team is committed to building a platform for growth and the development of its five million barrels of proved Eagle Ford and other oil reserves while continuing its focus on operating efficiencies and cost control.

Forward Looking Statements

In addition to historical information contained herein, this news release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, subject to various risks and uncertainties that could cause the Company’s actual results to differ materially from those in the “forward-looking” statements. Although Lucas believes that the expectations reflected in such forward-looking statements are reasonable, these statements involve risks and uncertainties that may cause actual future activities and results to be materially different from those suggested or described in this news release. These risks and uncertainties include, but are not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination of the asset purchase agreement; and the inability to complete the transaction due to the failure to satisfy any of the conditions to completion of the transaction. These also include risks inherent in natural gas and oil drilling and production activities, including risks of fire, explosion, blowouts, pipe failure, casing collapse, unusual or unexpected formation pressures, environmental hazards, and other operating and production risks, which may temporarily or permanently reduce production or cause initial production or test results to not be indicative of future well performance or delay the timing of sales or completion of drilling operations; delays in receipt of drilling permits; risks with respect to natural gas and oil prices, a material decline which could cause Lucas to delay or suspend planned drilling operations or reduce production levels; risks relating to the availability of capital to fund drilling operations that can be adversely affected by adverse drilling results, production declines and declines in natural gas and oil prices; risks relating to unexpected adverse developments in the status of properties; risks relating to the absence or delay in receipt of government approvals or fourth party consents; and other risks described in Lucas’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the SEC, available at the SEC’s website at www.sec.gov. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected. The forward-looking statements in this press release are made as of the date hereof. The Company takes no obligation to update or correct its own forward-looking statements, except as required by law, or those prepared by third parties that are not paid for by the Company. The Company’s SEC filings are available at http://www.sec.gov.

Important Information

In connection with the planned acquisition described above, Lucas currently intends to file a registration statement and a proxy statement with the Securities and Exchange Commission (the “SEC”). This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other document Lucas may file with the SEC in connection with the proposed transaction. Prospective investors are urged to read the registration statement and the proxy statement, when filed as they will contain important information. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of Lucas. Prospective investors may obtain free copies of the registration statement and the proxy statement, when filed, as well as other filings containing information about Lucas, without charge, at the SEC’s website (www.sec.gov). Copies of Lucas’ SEC filings may also be obtained from Lucas without charge at Lucas’ website (www.lucasenergy.com) or by directing a request to Lucas at (713) 528-1881. This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

INVESTORS SHOULD READ THE PROXY STATEMENT AND OTHER DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TRANSACTION.

Participants in Solicitation

Lucas and its directors and executive officers and other members of management and employees are potential participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Lucas’ directors and executive officers is available in Lucas’ Annual Report on Form 10-K for the year ended March 31, 2015, filed with the SEC on July 14, 2015 and Lucas’ definitive proxy statement on Schedule 14A, filed with the SEC on February 9, 2015. Additional information regarding the interests of such potential participants will be included in the registration statement and proxy statement to be filed with the SEC by Lucas in connection with the proposed transaction and in other relevant documents filed by Lucas with the SEC. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

Contact:

Carol Coale / Ken Dennard

Dennard Lascar Associates, LLC

(713) 529-6600

ccoale@dennardlascar.com

ken@dennardlascar.com

http://www.dennardlascar.com

Biotech

CytoDyn Inc (OTCMKTS:CYDY) Regains Momentum After The Big Announcement

Published

5 years agoon

July 20, 2020Now that the market seems to be coming back into his elements, it could be time for investors to start looking into penny stocks more closely. These stocks may often be risky, but if one makes the right choice, then the rewards could be enormous. One penny stock that could be put into the watch list at this point in time is that of CytoDyn Inc (OTCMKTS:CYDY).

The late-stage biotechnology company, which is developing the coronavirus medicine leronlimab, announced last week that it had filed a comprehensive application for uplisting on NASDAQ. The company announced that it believes that its application satisfies the myriad listing requirements of the NASDAQ Capital Market.

The Chief Executive Officer and President of the company Nader Pourhassan stated that while it is true that the entire process is expected to take many weeks, CytoDyn is hopeful of success in this matter.

He went on to state that a listing on NASDAQ will not only provide shareholders with more liquidity but also give CytoDyn much bigger access to fresh capital. It is a significant development for the company, and the market participants realized it as well. After the announcement was made, the stock rallied by as much as 50%. Investors could do well to keep an eye on the stock this week.

While the rally following this announcement was a welcome relief for the company, it is important to point out that earlier on in the week, the stock has fallen considerably following a setback. Last Monday, the company announced that the United States Food and Drug Administration handed CytoDyn a refusal to file a letter with regards to the usage of leronlimab to treat HIV.

However, at the same time, investors should be noted that the company did announce that it is confident of furnishing the agency with all the further details that have been demanded. It is one of the penny stocks that have performed remarkably well this year so far, and investors could keep an eye on it.

Market

These 3 Pot Stocks Are Up Big Since May: What’s the Buzz?

Published

5 years agoon

July 20, 2020Over the course of the past year or so, pot stocks had generally struggled, but during the past month, those stocks have recovered nicely. The stock market suffered a historic fall due to the economic turmoil caused by the coronavirus pandemic. It is believed that investors who are looking for value have descended on the beaten-down pot stocks. On the flip side, these stocks could also have been identified as defensive plays in an uncertain market environment.

That being said, it should be noted that despite the gains recorded by many stocks, most of those stocks are still considerably lower than the all-time highs. In such a situation, it could be worthwhile for investors to take a closer look at some of the strongest and more stable cannabis companies in the industry. Here is a look at three pot stocks that made significant moves in May and could be tracked by investors at this point.

1. HEXO Stock Jumps Ahead of Earnings

HEXO Corp (TSX:HEXO) (NYSE:HEXO) is one of those cannabis companies which have had a particularly tough time over the past year or so. However, the stock has emerged as one of the bigger gainers among pot stocks in recent trading sessions. The Hexo stock has gained as much as 120% over the course of the past month. The company is all set to release its financial results for the fiscal third quarter on Thursday, and hence, it could be a big week for the stock.

The recent surge in the Hexo stock may have come as a major boost to investors, but it should be noted that over the past year, it recorded considerable losses. The beaten-down nature of the stock may have contributed to the stock becoming more attractive for investors. However, the trajectory of the Hexo stock in the near term is going to depend a lot on its third-quarter earnings.

The company had made a loss of $298 million in the previous quarter, and while it is almost certain that it is going to make a loss again, the size of the loss is going to be keenly watched. Additionally, any writedowns are also going to be harmful to the stock. Investors should also keep an eye on sales growth.

2 Organigram gains Momentum on Value Buying

Organigram Holdings (TSX:OGI) (NASDAQ:OGI) is another pot stock that has made significant gains in the past month. Since May 13, the stock has gained as much as 80%. In April, the company announced its fiscal second-quarter results, but it had been a disappointment.

Revenues dropped by 13.7% year on year to hit CA$23.2 million, and losses widened to CA$6.8 million from CA$6.4 million in the prior-year period. However, one significant cause for optimism for Organigram investors is the fact that in the second quarter, cannabis 2.0 products made up as much as 13% of its revenue. That has opened up a whole new opportunity for the company.

Wholesale cannabis revenue made up 24% of the net, and that is again a new source of revenue. The company blamed the lower volumes of flower as well as cannabis oil for the drop in sales. Organigram reported cash and cash equivalents of CA$41.1 million as of February 29. Considering the fact that it has burned CA$25 million in the past six months, investors should not use that the cash balance does not paint a pretty picture.

3 Aphria Recovers Following Solid Earnings

Aphria (TSX:APHA) (NYSE:APHA), on the other hand, managed to perform relatively well in its fiscal third quarter. The net sales rose by as much as 19.7% sequentially to hit CA$144.4 million, and more importantly, the company also managed to record a profit for the third time in four quarters. On top of that, it should be noted that although the Canadian cannabis company spends CA$124.4 million on its operations in the nine months trailing that quarter, it still reported a cash balance of CA$515 million.

The performance seems to have buoyed market participants as well, and the stock has rallied by as much as 75% since the middle of May. One of the most important things that investors are going to be looking into is whether Aphria is going to be able to maintain its profitability.

However, due to the turmoil caused by the coronavirus pandemic, it might prove difficult. That being said, it should be noted that the pandemic is going to have an equally damaging effect across the sector.

Market

ConforMIS Inc (NASDAQ: CFMS): Premium Members Made A Quick 65% Profit In Just 1 week

Published

7 years agoon

March 19, 2019Well, as we know there are two types of person in the stock market one is trader and another is investor. Investors tend to put money for longer time, while traders make short term bets. We know, its not at all easy to make money in the short term especially in the equity markets. However, premium members at Traders Insights are making awesome money on our calls on our swing trading calls. WE ARE OFFERING A SPECIAL 7-Day Trial Period at Just $5 (so that everybody can make money with us and join us if satisfied). Register Here http://tradersinsights.com/pricing/

JOIN US NOW: For Details Contact us at info@tradersinsights.com

Or You can send me a friend request on facebook here https://www.facebook.com/sebastian.gomestradersinsights

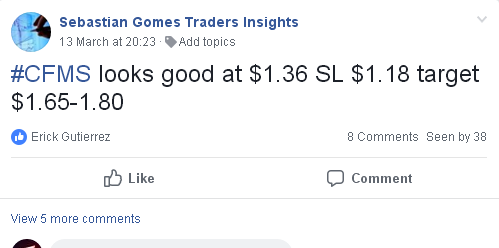

Now let me show you how we made quick 43% in just 1-week which was posted to our premium members:-

We told our members in facebook private group to buy ConforMIS Inc (NASDAQ: CFMS) yesterday (march 13th) at $1.36. Now look at the price of the stock – its up 65% at $2.25 from our buy price. This is how easy money they made. If you had invested $5,000 in CFMS, it could had been moved up to $8,250. It’s not yet late, join us at info@tradersinsights.com