Market

If You Could Have Bought GW Pharmaceuticals PLC- ADR(NASDAQ:GWPH) & Insys Therapeutics Inc (NASDAQ:INSY) at 0.02 Would You?

Published

11 years agoon

In the OTC and Pinksheet markets investors have been cautious following the massive surge that the marijuana sector saw early last year with Colorado coming online as the very first state in the US to legalize the use of cannabis for recreational purposes. Many companies trading in the penny stock markets did nearly anything they could do in order to take advantage of the mass appeal coming from this industry boom. But now with a new year upon us, a seemingly smarter small and micro-cap stock investing public is looking for real value in the space and not just “another grow operation hoping for state licensing”.

Right now, attention seems to be in the biotech space as much of this “long term” potential for the marijuana industry is held by medical applications in such things as CBD’s and hemp derivatives to treat specific diseases like epilepsy and certain cancers. If there’s one marijuana stock that’s remained in the “Top Ten”, it’s been GW Pharma (GWPH) and more recently, INSYS Therapeutics (INSY) both of which have novel therapies for numerous diseases such as different types of cancers.

In 2014 for example, the stock price for GWPH jumped to highs of $111.46 prior to pulling back to lows that were below $60 per share.

On the flip side, INSYS was recently granted orphan drug designation by the FDA and share prices have to highs of $47.18.

But what if you could have owned GWPH or INSY prior to prices jumping as high as they have? What if there was an opportunity to see these companies at levels around $0.02? The obvious answer (in my opinion) would be “I would definitely buy”. A small investment at a price like that would be absolutely life-changing at today’s prices, let alone at the all time highs that these stock have seen over the last 12 months.

One company that has just come to light with a very strong team coupled with a similar vision and ground breaking assets is Oxis Biotech, Inc. Now, I say recent because it was just last week that this company had a caveat emptor removed on OTCMarkets.com for being delinquent in its filings for quite some time. As of Friday OXIS showed that it had successfully filed all delinquent financial statements bringing the company current. In looking at the share structure, stock price, and market cap, this company looks like it could have what it takes to go to a higher exchange like the QB as long as it meets the requirements. Furthermore, the company’s website just began to have updated content populated throughout its pages.

So What’s So Important That OXIS Could Be The Next INSY or GWPH?

First and foremost, Oxis International completed an additional round of financing in the amount of $1.25 million and an earlier round of financing completed in July of $1.425 million, brings the funding total for 2014 to $2.675 million. According to Oxis, it will use the proceeds to fund Oxis Biotech, Inc. activities related to the acquisition and/or licensing of cannabis related intellectual properties, marketing of Oxis International, Inc’s nutraceutical products, and general corporate purposes.

But you really need a firm and well-seasoned leadership team to be able to effectively appropriate funds like this. Anthony Cataldo has been named Chief Executive Officer of Oxis International, Inc. Cataldo will continue to serve as Chairman of Oxis International, Inc. and President of Oxis Biotech, Inc. a wholly owned subsidiary of Oxis International. Inc. Cataldo has a track record of building successful biotechs.

From February 2011 to June 2013 Cataldo served as Chairman/CEO of Genesis Biopharma, inc. (Previous: GNBP), now known as Lion Biotechnologies, Inc., (LBIO) and currently trades over $8/share. Keep in mind that Cataldo created Lion/Genesis with the inclusion of assets acquired from the National Cancer Institute for the treatment of stage-four melanoma. With such a track record within the space and a penchant for success in biotech, this may be just the beginning for OXIS as it has just begun to see trading. From early December up until recent, the stock price for Oxis Biotech has consistently remained in an uptrend moving as high as $0.0399 during the first few days of the new year.

Furthermore OXIS most recently announced that it executed definitive agreements licensing certain assets for the treatment of Multiple Myeloma and initiated a consulting agreement with University of Pittsburgh’s Professor, Dr. Xiang-Qun(Sean)Xie (one of the world’s foremost cannabinoid research scientists). The American Cancer Society’s estimates for multiple myeloma in the United States for 2015 are about 26,850 new cases of multiple myeloma and about 11,240 deaths from multiple myeloma alone.

The license agreement provides Oxis Biotech, Inc an exclusive worldwide license to develop and commercialize therapies for the treatment of Multiple Myeloma (a type of cancer that attacks plasma cells in bone marrow). Dr. Xie joins Oxis Biotech as a consultant and member of the Science Advisory Board to further develop the assets licensed to Oxis Biotech, Inc. Among the mile-long track record of amazing accomplishments that Dr. Xie holds (See below), he is a recipient of the 2014 American Association of Pharmaceutical Scientists (AAPS) Outstanding Research Achievement Award.

Mr. Cataldo stated, “I wanted to leverage Dr. Xie’s significant experience and technologies, much the same way I did when I acquired highly valued patents from the NCI (NIH) for stage 4 Melanoma from the National Cancer Institute to form Lion Biotechnologies, Inc. (LBIO)”.

In addition to this, University of Pittsburgh’s new Chancellor Patrick Gallagher encourages industry partnership of the University with OXIS. This will further enhance the overall R & D capabilities of the company and could propel the company’s growth by leaps and bounds just as the case was for market leaders like GW Pharma.

R&D FACTS:

After studying the effects of cannabidiol on multiple myeloma cells, researchers found that; “CBD by itself or in synergy with BORT strongly inhibited growth, arrested cell cycle progression and induced MM cells death by regulating the ERK, AKT and NF-κB pathways with major effects in TRPV2+ cells.”

They conclude that; “These data provide a rationale for using CBD to increase the activity of proteasome inhibitors in MM.”

The study, which validates a recent National Institute of Health study which also found that cannabidiol can inhibit cancer cells, was conducted by researchers at the School of Pharmacy at the University of Camerino in Italy.

This is obviously a developing story but if history repeats itself with Cataldo at the helm of Oxis in addition to Dr. Xie in charge of building the infrastructure to deploy this tharepy, the real benefit could be to those early shareholders looking for untapped opportunity in the cannabis biotech sector. Right now this is a reality for OXIS and its shareholders. The company has brought on both proven leadership and a world-renowned scientist for cannabinoid research immediately following the company becoming current in its filings and in my opinion could position Oxis to truly become the next big player in medical cannabis.

In a time where Bob Marley and Tommy Chong are producing their own brands of medical/recreational marijuana, the industry is booming with progress. More states have come on board the legal marijuana money train and even more are beginning to put legislation plans in place to push through some kind of bill come the next election period. The doors have opened even wider for real progress to be found within this burgeoning industry and from where I sit, it could be these medically focused organizations that will reap the biggest rewards from the forward looking nature that the biotech space has historically shown to have.

More About Dr. Xiang-Qun (Sean) Xie

Sean Xie, MD, PhD, EMBA is a tenured Professor at the Department of Pharmaceutical Sciences/Drug Discovery Institute at University of Pittsburgh and Associate Dean for Research Innovation at the School of Pharmacy. He is Principal Investigator of an integrated research laboratory of CompuGroup, BioGroup and ChemGroup, and Founding Director of Computational Chemical Genomics Screening Center. Dr. Xie is also Director/PI of NIH funded National Center of Excellence for Computational Drug Abuse Research. Dr. Xie holds joint faculty positions at the Departments of Computational System Biology and Structural Biology, and Pittsburgh Cancer Institute MT/DD Program.

Xie is a charter member of the NIH BPNS Study Section Review Panel, an oversea expert reviewer for the Chinese Natural Science Foundation, ad hoc reviewer for the Netherlands Organizations for Scientific Research Council for Chemical Sciences, MCMB Foundation for MRC UK, and the Wellcome Trust Fund, Sir Henry Wellcome Fellowship, London, UK. He serves as an invited guest editor for AAPS Journal, Editorial Board of American Journal of Molecular Biology, and Associate Editor of BMC Pharmacology and Toxicology.

He was an invited international Assessment Panelist for Fudan University College of Pharmacy, a member of the Board of Directors of the Chinese Association of Professionals in Science and Technology, and a Chair of the CAPST Biomedical and Pharmaceutical Society. Dr. Xie also holds adjunct professor title in top institutes and colleges of pharmacy in China, including CAMS Tianjin Institute of Hematology Stem Cell Medical Center; Fudan, Shanghai Jiaotong, and Zhejiang Universities. In 2013, he was named an honorary professor of Chinese Academy of Medical Sciences & Peking Union Medical College.

You may like

-

Biotech Stocks to Watch in 2015: Oxis International (OTCMKTS:OXIS), Medical Marijuana, Inc. (OTCMKTS:MJNA), Cannabis Science, Inc. (OTCMKTS:CBIS)

-

Stocks To Watch: Navidea Biopharmaceuticals Inc(NYSEMKT:NAVB), Insys Therapeutics Inc (NASDAQ:INSY), PTC Therapeutics, Inc. (NASDAQ:PTCT)

-

Watch List: Insys Therapeutics Inc (NASDAQ:INSY), Elephant Talk Communications Corp(NYSEMKT:ETAK), Las Vegas Sands Corp.(NYSE:LVS)

Biotech

CytoDyn Inc (OTCMKTS:CYDY) Regains Momentum After The Big Announcement

Published

5 years agoon

July 20, 2020Now that the market seems to be coming back into his elements, it could be time for investors to start looking into penny stocks more closely. These stocks may often be risky, but if one makes the right choice, then the rewards could be enormous. One penny stock that could be put into the watch list at this point in time is that of CytoDyn Inc (OTCMKTS:CYDY).

The late-stage biotechnology company, which is developing the coronavirus medicine leronlimab, announced last week that it had filed a comprehensive application for uplisting on NASDAQ. The company announced that it believes that its application satisfies the myriad listing requirements of the NASDAQ Capital Market.

The Chief Executive Officer and President of the company Nader Pourhassan stated that while it is true that the entire process is expected to take many weeks, CytoDyn is hopeful of success in this matter.

He went on to state that a listing on NASDAQ will not only provide shareholders with more liquidity but also give CytoDyn much bigger access to fresh capital. It is a significant development for the company, and the market participants realized it as well. After the announcement was made, the stock rallied by as much as 50%. Investors could do well to keep an eye on the stock this week.

While the rally following this announcement was a welcome relief for the company, it is important to point out that earlier on in the week, the stock has fallen considerably following a setback. Last Monday, the company announced that the United States Food and Drug Administration handed CytoDyn a refusal to file a letter with regards to the usage of leronlimab to treat HIV.

However, at the same time, investors should be noted that the company did announce that it is confident of furnishing the agency with all the further details that have been demanded. It is one of the penny stocks that have performed remarkably well this year so far, and investors could keep an eye on it.

Market

These 3 Pot Stocks Are Up Big Since May: What’s the Buzz?

Published

5 years agoon

July 20, 2020Over the course of the past year or so, pot stocks had generally struggled, but during the past month, those stocks have recovered nicely. The stock market suffered a historic fall due to the economic turmoil caused by the coronavirus pandemic. It is believed that investors who are looking for value have descended on the beaten-down pot stocks. On the flip side, these stocks could also have been identified as defensive plays in an uncertain market environment.

That being said, it should be noted that despite the gains recorded by many stocks, most of those stocks are still considerably lower than the all-time highs. In such a situation, it could be worthwhile for investors to take a closer look at some of the strongest and more stable cannabis companies in the industry. Here is a look at three pot stocks that made significant moves in May and could be tracked by investors at this point.

1. HEXO Stock Jumps Ahead of Earnings

HEXO Corp (TSX:HEXO) (NYSE:HEXO) is one of those cannabis companies which have had a particularly tough time over the past year or so. However, the stock has emerged as one of the bigger gainers among pot stocks in recent trading sessions. The Hexo stock has gained as much as 120% over the course of the past month. The company is all set to release its financial results for the fiscal third quarter on Thursday, and hence, it could be a big week for the stock.

The recent surge in the Hexo stock may have come as a major boost to investors, but it should be noted that over the past year, it recorded considerable losses. The beaten-down nature of the stock may have contributed to the stock becoming more attractive for investors. However, the trajectory of the Hexo stock in the near term is going to depend a lot on its third-quarter earnings.

The company had made a loss of $298 million in the previous quarter, and while it is almost certain that it is going to make a loss again, the size of the loss is going to be keenly watched. Additionally, any writedowns are also going to be harmful to the stock. Investors should also keep an eye on sales growth.

2 Organigram gains Momentum on Value Buying

Organigram Holdings (TSX:OGI) (NASDAQ:OGI) is another pot stock that has made significant gains in the past month. Since May 13, the stock has gained as much as 80%. In April, the company announced its fiscal second-quarter results, but it had been a disappointment.

Revenues dropped by 13.7% year on year to hit CA$23.2 million, and losses widened to CA$6.8 million from CA$6.4 million in the prior-year period. However, one significant cause for optimism for Organigram investors is the fact that in the second quarter, cannabis 2.0 products made up as much as 13% of its revenue. That has opened up a whole new opportunity for the company.

Wholesale cannabis revenue made up 24% of the net, and that is again a new source of revenue. The company blamed the lower volumes of flower as well as cannabis oil for the drop in sales. Organigram reported cash and cash equivalents of CA$41.1 million as of February 29. Considering the fact that it has burned CA$25 million in the past six months, investors should not use that the cash balance does not paint a pretty picture.

3 Aphria Recovers Following Solid Earnings

Aphria (TSX:APHA) (NYSE:APHA), on the other hand, managed to perform relatively well in its fiscal third quarter. The net sales rose by as much as 19.7% sequentially to hit CA$144.4 million, and more importantly, the company also managed to record a profit for the third time in four quarters. On top of that, it should be noted that although the Canadian cannabis company spends CA$124.4 million on its operations in the nine months trailing that quarter, it still reported a cash balance of CA$515 million.

The performance seems to have buoyed market participants as well, and the stock has rallied by as much as 75% since the middle of May. One of the most important things that investors are going to be looking into is whether Aphria is going to be able to maintain its profitability.

However, due to the turmoil caused by the coronavirus pandemic, it might prove difficult. That being said, it should be noted that the pandemic is going to have an equally damaging effect across the sector.

Market

ConforMIS Inc (NASDAQ: CFMS): Premium Members Made A Quick 65% Profit In Just 1 week

Published

7 years agoon

March 19, 2019Well, as we know there are two types of person in the stock market one is trader and another is investor. Investors tend to put money for longer time, while traders make short term bets. We know, its not at all easy to make money in the short term especially in the equity markets. However, premium members at Traders Insights are making awesome money on our calls on our swing trading calls. WE ARE OFFERING A SPECIAL 7-Day Trial Period at Just $5 (so that everybody can make money with us and join us if satisfied). Register Here http://tradersinsights.com/pricing/

JOIN US NOW: For Details Contact us at info@tradersinsights.com

Or You can send me a friend request on facebook here https://www.facebook.com/sebastian.gomestradersinsights

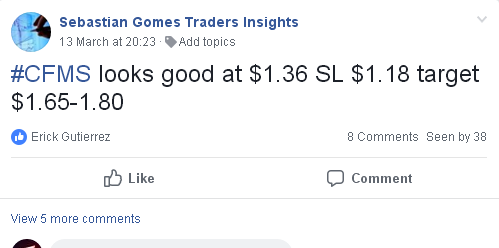

Now let me show you how we made quick 43% in just 1-week which was posted to our premium members:-

We told our members in facebook private group to buy ConforMIS Inc (NASDAQ: CFMS) yesterday (march 13th) at $1.36. Now look at the price of the stock – its up 65% at $2.25 from our buy price. This is how easy money they made. If you had invested $5,000 in CFMS, it could had been moved up to $8,250. It’s not yet late, join us at info@tradersinsights.com