The death of a young boy who suffered a severe allergic reaction to fire ants during a middle school football game has added fuel to the debate about whether schools should stock epinephrine for severe allergy attacks.

Cameron Espinosa, just 13, was in the huddle with his teammates at Paul R. Haas Middle School in Corpus Christi Texas last September when he started screaming, “Ants! Ants! Ants!,” according to those at the scene. He collapsed and was rushed to a nearby children’s hospital. He died a few days later.

He died just one week after a bill was introduced to the U.S. Senate that would encourage states to require schools to stock life saving epinephrine in an injectable form, which drives adrenaline into the person suffering from an allergic attack.

“My baby could be here if there were more trained personnel on the field … an EpiPen or something could have saved him, at least,” claimed Cameron’s mother, Josephine Limon.

“My baby could be here if there were more trained personnel on the field … an EpiPen or something could have saved him, at least,” claimed Cameron’s mother, Josephine Limon.

Allergies affect up to 40% of the world population. Most commonly treated with prescription medication, the annual cost of treatment is in excess of $40 billion.

A smaller group of allergy sufferers have anaphylaxis (allergy shock) brought on by exposure to peanuts, tree nuts, other foods, insect venom, latex and drugs. Estimates are that over 100 million fall in to this group. The cornerstone for the emergency treatment of symptoms in these patients is the use of epinephrine by an auto-injector. Although there have been these types of products for over 30 years, to date less than 4% of patients have access to them. There are a number of reasons for this poor penetration, but high pricing is one of the major stumbling blocks.

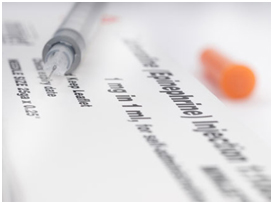

Allerayde SAB, Inc. (ASAB) has developed a new epinephrine auto-injector, the AAA Pen, which will be available at a considerably lower price. This will not only stimulate sales in existing markets but will also open up developing markets. Further development on the AAA Pen will see the addition of a GPS device to improve the outcome for the patient. This development has been awarded a grant from the European Space Agency.

Allerayde SAB, Inc. (ASAB) principal product is the AAAPen®. The AAAPen® is a new anaphylaxis pen for the emergency treatment of anaphylaxis, or severe allergic shock, which may be identified by various rapid onset symptoms following exposure to certain allergens—such as insect venoms, peanuts, seafood, latex, etc.— that have caused symptoms from different leveled reactions. When the first signs of anaphylaxis being experienced, the AAAPen® can be used.

The AAAPen®, a third generation device after Epipen and Anapen, avoids many of the technical shortcomings and high costs of manufacturing of the earlier devices.

The Company anticipates that the AAAPen® will deliver much higher reliability than existing products in the market and at a selling price of approximately half of the current leader’s in the field.

How You Can See Big Gains with ASAB

The Opportunity

The Opportunity

ASAB now has the opportunity to make significant sales in the allergy/eczema market, where revenue is well in excess of $40 billion, with epinephrine auto-injectors having over $750 million and both are growing. The availability of a generic epinephrine auto-injector will also open up previously untapped markets.

The Allergy Market

Asthma and allergic diseases account for a significant proportion of the chronic illnesses that afflict human beings. Worldwide, asthma has been described as an epidemic that has increased both in prevalence and incidence over the last 20 years despite improved pharmacotherapy and environmental control. In the same way, allergic diseases such as rhinitis, food allergy, atopic dermatitis and asthma triggered by allergies have also increased. The total burden of these chronic diseases is staggering.

Recent estimates of the annual cost of asthma in the USA are nearly $18 billon per year; with direct costs (treatment) nearly $10 billion.

In addition to asthma, it has been estimated that 1 in 5 Americans, or 50 million persons, experience allergies, including nasal allergies, food allergy, drug allergy, atopic eczema, and insect allergy. The incidence of allergic diseases has been increasing in all age groups for the past 20 years.

The annual cost of such allergies in the USA is estimated to be nearly $7 billion.

Future Growth

The numbers of patients in ASAB target markets has been growing rapidly for the last four decades, reaching up to 40%, and will continue to do so for the foreseeable future.

The numbers of patients in ASAB target markets has been growing rapidly for the last four decades, reaching up to 40%, and will continue to do so for the foreseeable future.

With a combination of existing products, new developments across the range and opening up previously untapped markets in developing countries the potential for growth very strong.

Investing in ASAB – Big Gains Possible

The ASAB Management team has a strong and aggressive business plan. The Company plans to offer the pen directly in the key markets of the UK, Ireland, France, Germany, USA and Canada, through its own subsidiaries and via carefully selected distributors in the remaining markets Distributors have already been identified for Scandinavia, Switzerland, Eastern Europe and Australia/New Zealand.

ASAB has a major objective of entering high growth branded markets with a worldwide value of over $750 million.

The key to successful investing has always been “Buy low. Sell high.” That applies to ASAB right now. At current trading levels ASAB is a bargain buy. As more and more investors discover this little gem the stock price will climb.

A quick jump from $0.20 to $1.00 is not unheard of in the penny stock market. Once the $1.00 level is hit there’s really no telling how high ASAB can go. ASAB can mean big gains for smart investors.

For more on this exciting company Click Here.